Index-Linked Annuity Payment Adjustment Rider

– Increases Settlement Payments if the Market Rises –

– Stable Floor: No Loss if the Market Declines –

You may be aware of the benefits of structured settlement annuities for both your client as well as yourself, in the form of structured attorney’s fees.

Well, the first major change in the structured settlement industry in decades has just been announced. Pacific Life is now offering a new Index-Linked Annuity Payment Adjustment Rider which can be added to new structured settlement annuity contracts. This Index-Linked Rider allows for growth potential with future lifetime and certain structured annuity payouts while maintaining the guaranteed, tax-free (plaintiff) or tax-deferred (attorney’s fees) benefits that a “standard” structured settlement offers.

A sample of the potential growth model is detailed below.

Growth Potential

As part of your strategy, you may want to give your structured settlement payments an opportunity to increase over time, like an occasional pay raise. It can help you manage expenses, or it may simply provide a bit more freedom to do things you enjoy.

By adding this optional rider to your structured settlement:

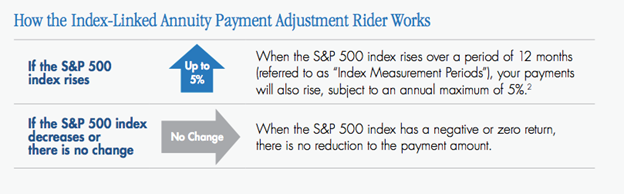

- Payments can increase based on positive S&P 500® index returns.

- No decrease in payments if the S&P 500 index declines or remains flat. The S&P 500 index is a market capitalization-weighted index of 500 companies in leading industries of the U.S. economy.

Growth and Protection

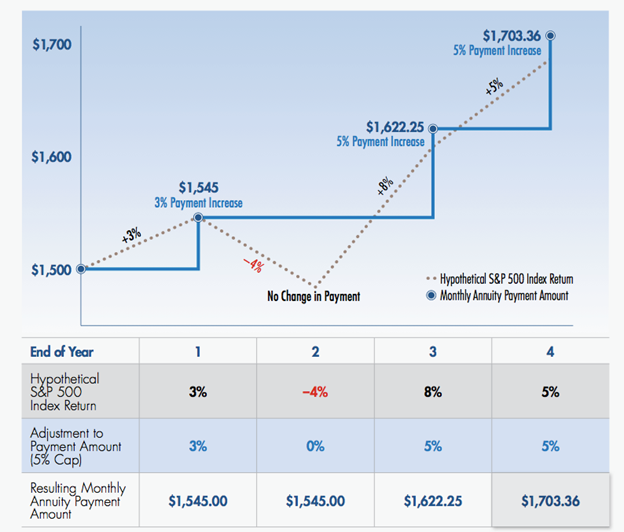

You can earn additional payment amounts based on any positive movement of the S&P 500 index. The following example helps to demonstrate how the rider works. Assumptions 3:

- The four-year returns for the S&P 500 index are for hypothetical demonstration purposes only.

- The rider was added when the annuity was purchased.

- Initial structured settlement monthly annuity payment amount is $1,500 for the first year.

- The annual maximum annuity payment adjustment is 5%.

Attorney Fee Structures

This Index-Linked rider is available to be added to new Attorney Fee Structure policies as well. This rider may be the perfect answer for attorneys who are looking for stable, low-risk investment vehicles which can take advantage of any measurable growth in the market.

Please be advised these riders can only be added to new structured annuity policies and must be added at the time that the scenario is selected.

The index-linked rider requires a higher premium to match payout amounts of annuity streams without such riders, like that of payment streams that incorporate an inflation rider.

If you have any questions regarding the Linked-Index Annuity Rider or wish to request quotes for a particular case, please feel free to call Paramount at 888-674-0127. One of Paramount’s advisors would be happy to discuss the benefits of this rider with you.

- The S&P 500 index is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Pacific Life Insurance Company. Standard & Poor’s®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Pacific Life. Pacific Life’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s), nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 index. The index is unmanaged and cannot be invested in directly, and index performance does not include the reinvestment of dividends.

- Index Measurement Periods are not calendar years. They are defined according to when your annuity payments begin. Increases in the index are measured by the percentage difference between the index on the first and last day of each Index Measurement Period. Payment increases take effect on the anniversary of when payments originally started. Cost-of-living adjustment and the Index-Linked Annuity Payment Adjustment Rider cannot be used together with the same payment stream. Selecting the Index-Linked Annuity Payment Adjustment Rider may result in a varying benefit amount based on the annuity type and period selected.

This material is not intended to be used, nor can it be used by any taxpayer, for the purpose of avoiding U.S. federal, state, or local tax penalties. This material is written to support the promotion or marketing of the transaction(s) or matter(s) addressed by this material. Pacific Life, its distributors, and respective representatives do not provide tax, accounting, or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney.

Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company (Newport Beach, CA). Pacific Life & Annuity Company will issue annuity policies if ANY of the following occurs inside the state of New York: solicitation, sales, negotiation of settlement, court/legal action, or claimant/payee residence. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each company is solely responsible for the financial obligations accruing under the products it issues. Insurance products are backed by the financial strength and claims-paying ability of the issuing company.

This material may be used only in connection with the solicitation of Pacific Life Insurance Company products in those states where the product solicited has been approved. Product features and availability may vary by state.